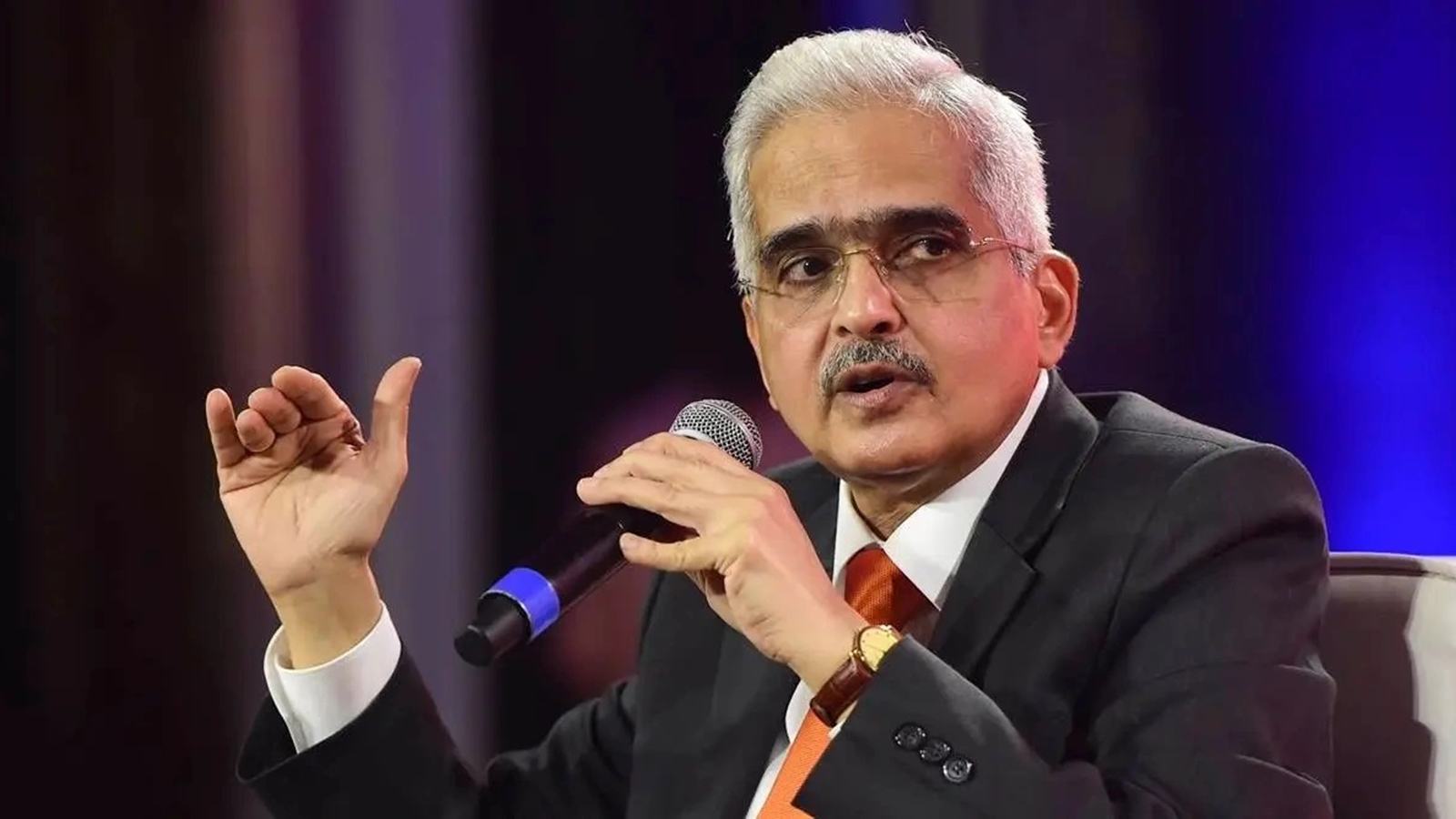

In a recent statement, Reserve Bank of India (RBI) Governor Shaktikanta Das emphasized the need for lower borrowings to stimulate economic growth and alleviate inflationary pressures. Das highlighted that reducing government borrowings is crucial for creating room for private investment and supporting economic expansion.

High levels of government borrowing can crowd out private investment by absorbing available funds in the financial system, thereby limiting credit availability for businesses and households. This can stifle economic growth and exacerbate inflationary pressures by increasing demand for limited goods and services.

SOURCE:- NEWS18

By advocating for lower government borrowings, Governor Das is aiming to create a conducive environment for private sector investment to flourish. Increased private investment can drive job creation, enhance productivity, and spur economic activity, ultimately contributing to sustainable growth.

SOURCE:- THE ECONOMIC TIMES

Furthermore, lower government borrowings can help ease inflationary pressures. Excessive borrowing can lead to higher demand for goods and services without a corresponding increase in supply, driving up prices and contributing to inflation. By reducing government borrowing, the RBI aims to mitigate these inflationary pressures and promote price stability in the economy.

Governor Das’s emphasis on reducing borrowings aligns with the RBI’s broader monetary policy objectives, which include maintaining price stability and supporting economic growth. Through various policy tools such as interest rate adjustments and liquidity management, the RBI seeks to achieve these objectives while also ensuring financial stability.

It’s worth noting that the government’s fiscal policy decisions, including its borrowing plans, play a significant role in shaping the macroeconomic environment. Collaboration between fiscal and monetary authorities is essential for achieving balanced economic outcomes.

In addition to advocating for lower government borrowings, Governor Das has emphasized the importance of structural reforms to enhance the economy’s resilience and competitiveness. Structural reforms aimed at improving factors such as infrastructure, labor market flexibility, and ease of doing business can have long-lasting positive effects on growth and inflation dynamics.

Overall, Governor Shaktikanta Das’s call for lower government borrowings reflects the RBI’s commitment to fostering sustainable economic growth and maintaining price stability. By creating space for private sector investment and addressing inflationary pressures, these efforts can contribute to a more robust and resilient economy in the long term.

Share your views in the comments