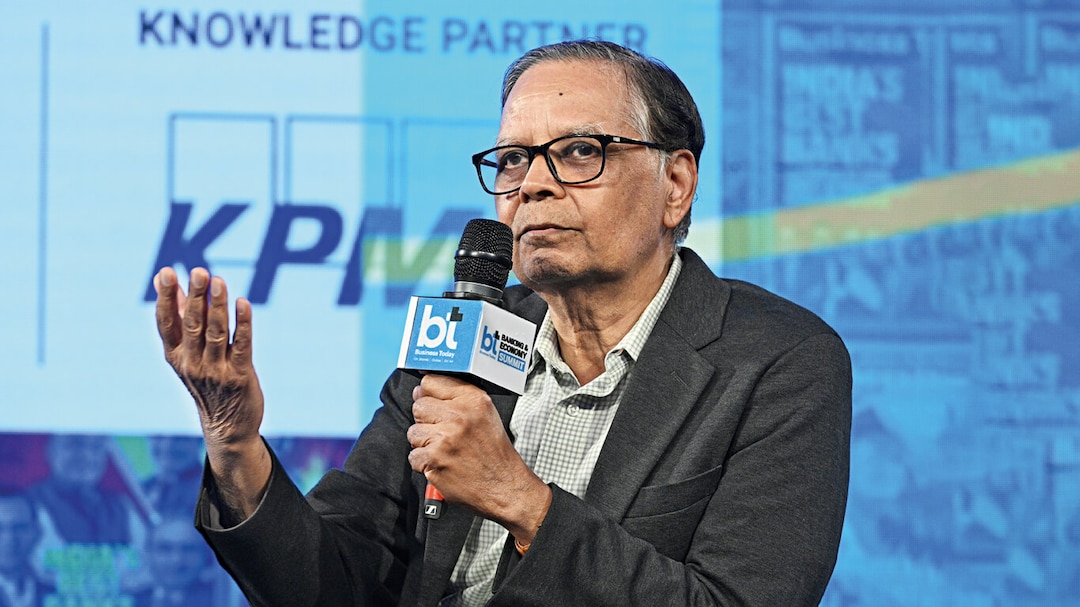

Arvind Panagariya, an esteemed economist, advocates for the privatization of public sector banks in India to bolster the economy. He contends that privatization can enhance efficiency, accountability, and innovation within the banking sector. Panagariya highlights the historical inefficiencies plaguing public sector banks, which have struggled with non-performing assets (NPAs) and bureaucratic hurdles.

Privatization, according to Panagariya, would introduce competition, driving banks to become more customer-centric and responsive to market demands. This, he believes, would lead to improved services and better allocation of resources. Additionally, privatization could attract foreign investment, injecting capital and expertise into the banking sector, thus fostering growth and stability.

Source:- BBC News

However, Panagariya acknowledges potential challenges in privatizing public sector banks. Political opposition, concerns over job losses, and the need for regulatory safeguards to prevent monopolistic practices are among the hurdles to overcome. Yet, he argues that the benefits of privatization outweigh these challenges in the long run.

Source:- India Today

Critics of privatization caution against potential downsides, such as reduced access to banking services for marginalized communities and increased inequality. They argue that privatization could prioritize profit over social welfare, exacerbating existing disparities.

Panagariya’s stance aligns with broader economic reforms aimed at liberalizing India’s economy and fostering competitiveness. He emphasizes the importance of creating an environment conducive to private investment and entrepreneurship to unleash India’s economic potential.

In conclusion, Arvind Panagariya advocates for the privatization of public sector banks in India as a means to invigorate the economy. While acknowledging challenges, he emphasizes the potential benefits of increased efficiency, competition, and foreign investment. However, the debate over privatization remains complex, with considerations for social equity and regulatory safeguards essential in shaping the future of India’s banking sector.

Share your views in the comments