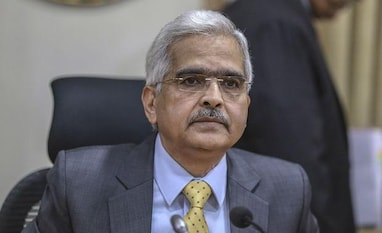

RBI Governor Shaktikanta Das recently clarified that the Reserve Bank of India (RBI) is not considering granting banking licenses to business houses at present. This statement comes amid ongoing discussions and debates about the involvement of large corporates in the banking sector.

Source:- BBC news

Das emphasized that the central bank’s primary focus remains on maintaining financial stability and ensuring a robust regulatory framework. He highlighted the potential risks associated with allowing business conglomerates to enter the banking space, such as conflicts of interest and the concentration of economic power.

Source:- India today

The RBI’s cautious stance reflects concerns over governance issues and the need to safeguard depositors’ interests. The central bank is committed to preserving the integrity of the banking system and preventing any undue influence that large business houses might exert.

While the idea of granting banking licenses to corporates has been suggested in various reports and recommendations, the RBI’s current priority is to strengthen the existing banking infrastructure. Das’s statement underscores the importance of a prudent approach in financial sector reforms, ensuring that any changes align with the broader objectives of stability and trust in the banking system.

Share your views in the comments