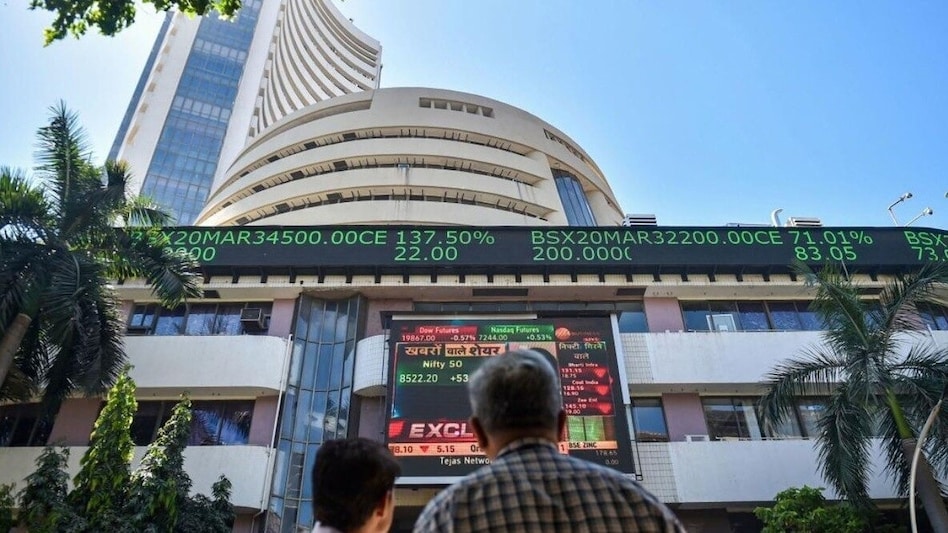

This week offers notable events for investors as Reliance Industries’ ex-bonus, Infosys’ dividend, and Waaree Energies’ IPO debut are set to impact the market.

Reliance Industries Ex-Bonus

Reliance Industries’ bonus issue of 1:1 will go ex-date this week, meaning each shareholder will receive one additional share for each share they hold. The record date is set for November 3, 2024, a key event for Reliance shareholders who are likely to see a boost in their investment. Bonus shares often increase stock liquidity and attract more retail investors. This move aligns with Reliance’s strategy to reward long-term shareholders, potentially enhancing investor confidence.

Source:- bbc news

Infosys Dividend

Infosys, one of India’s leading IT firms, is set to distribute its interim dividend of Rs 18 per share on November 1, 2024. This payment is an opportunity for shareholders to gain immediate value from their investments, adding to Infosys’ reputation for strong returns. Infosys’ continued dividend distributions reflect the company’s stable cash flow and solid financial performance, especially important in the context of global economic uncertainty affecting the tech sector.

Source:- bbc news

Waaree Energies IPO Debut

Solar energy solutions provider Waaree Energies is preparing for its IPO debut on November 3, 2024, in both the BSE and NSE. Given the increasing focus on renewable energy, this IPO has generated significant interest among investors. Waaree Energies aims to capitalize on the growing demand for clean energy and government initiatives promoting solar power. With a planned expansion into module manufacturing and other energy solutions, this IPO could see strong participation, making it a noteworthy opportunity for those eyeing India’s green energy sector.

Overall, investors should monitor these events as they could impact both the individual stocks and broader market sentiment, especially in sectors like energy, tech, and renewables.

Share your views in the comments