The Ministry of Finance recently reported contrasting trends in demand across rural and urban sectors during the first half of FY25. Rural demand showed signs of resilience and growth, while urban demand witnessed a decline. These shifts reflect varied economic pressures and recovery rates between the two segments, influenced by factors like agricultural performance, inflation, and evolving consumption patterns.

Source:- bbc news

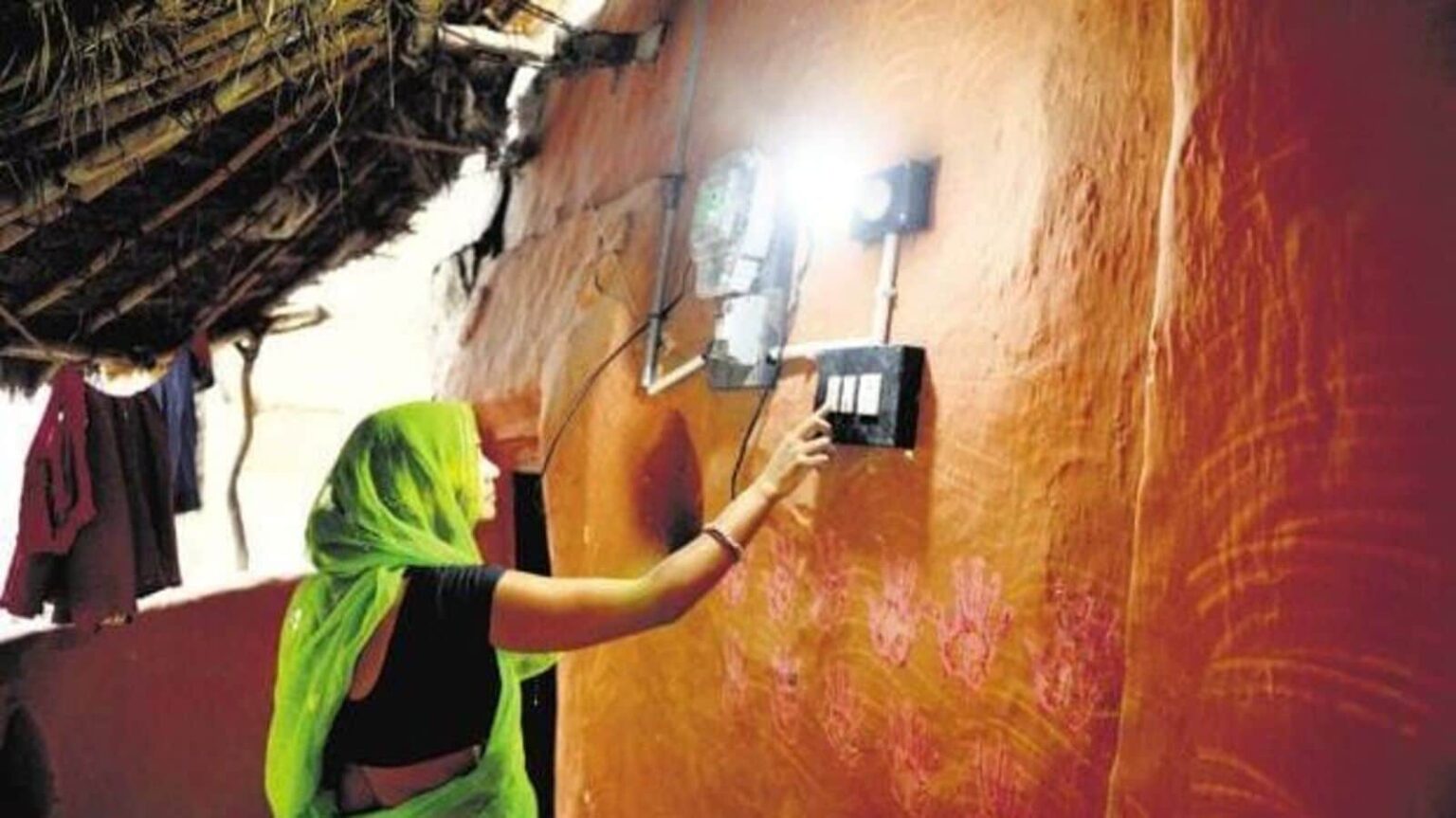

Rural demand was buoyed by favorable monsoon conditions in most parts of the country, aiding agricultural output and enhancing rural purchasing power. Government policies, such as increased support for rural employment schemes like MGNREGA and subsidy programs, further contributed to rural spending. These measures helped improve income stability in rural areas, fostering a boost in demand for consumer goods, agriculture-related machinery, and basic household items.

Source:- news 18

Conversely, urban demand slowed, primarily driven by inflationary pressures and cautious consumer sentiment amid rising interest rates. Urban households faced tighter disposable incomes due to higher costs of essential goods, which dampened demand for discretionary and high-value items like automobiles, electronics, and luxury products. Additionally, the slowing demand for real estate and reduced growth in sectors like IT and services impacted urban consumer spending, leading to a weaker demand trajectory.

The Ministry suggested that while inflation has eased slightly, persistent high prices continue to weigh on the urban segment. Analysts highlight that unless inflation and interest rates stabilize, the divergence between rural and urban demand may persist in the near term. Policy measures aimed at containing inflation and boosting income growth could help support a more balanced demand recovery across both sectors.

Overall, this divergence points to a need for tailored economic policies to support both rural growth and urban recovery, ensuring broader economic stability as India advances through FY25.

Share your views in the comments