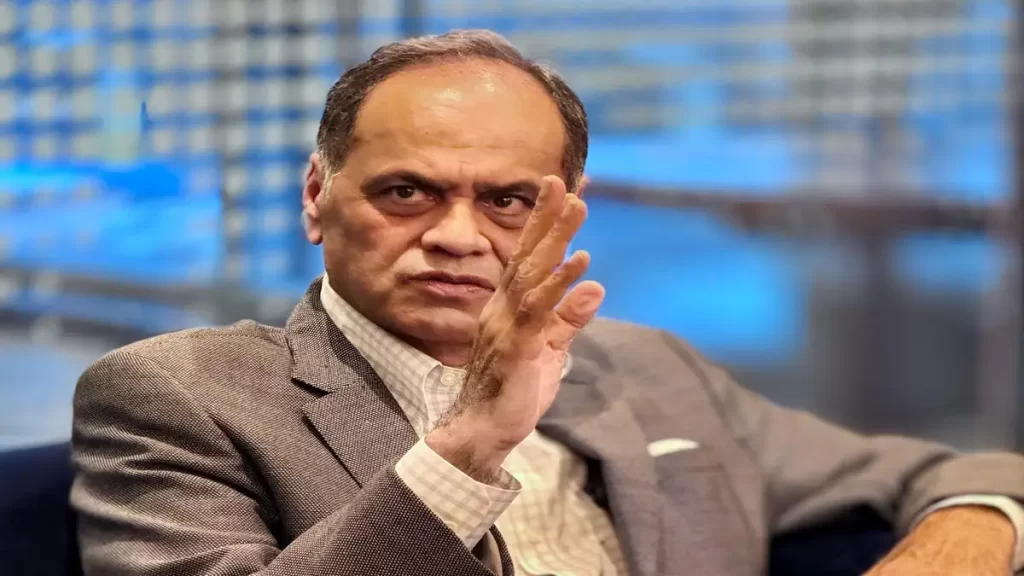

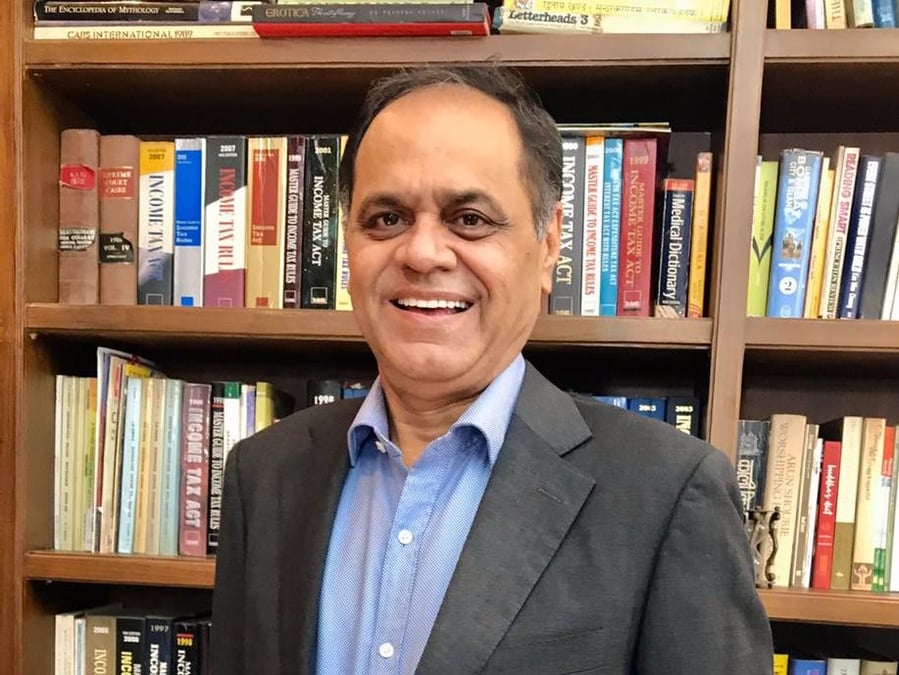

Ramesh Damani sees the potential re-election of Donald Trump as a catalyst for market volatility due to his unpredictable economic policies. A Trump victory could initially lead to market optimism, especially in sectors such as energy, defense, and technology, benefiting from pro-business policies like tax cuts and deregulation. However, Trump’s stance on tariffs and trade could raise inflationary pressures, leading to rising interest rates and a stronger U.S. dollar. This, in turn, could affect global markets, especially emerging economies dependent on U.S. trade.

Source:- bbc news

Despite possible short-term gains, his protectionist policies could hurt sectors sensitive to tariffs, like technology and manufacturing. With heightened uncertainty, financial markets could fluctuate rapidly as investors weigh these risks. A strong dollar could lead to weaker performance in foreign markets, particularly in Europe, which could face additional inflationary pressures if Trump targets European goods for tariffs.

Source:- news 18

Furthermore, Damani also highlights the rising inflation expectations that may come with Trump’s re-election, potentially prompting tighter monetary policy in the U.S. The S&P 500 might initially dip due to market concerns over trade tensions, and the U.S. Treasury market could see yields increase as expectations for a more aggressive Federal Reserve policy rise. In summary, while some sectors may thrive under a Trump administration, the overall economic outlook remains highly uncertain, making the market reaction complex and volatile.

The long-term impacts of a second Trump term would depend on the trajectory of his policies, which are difficult to predict but likely to introduce increased economic and geopolitical risks for investors

Share your views in the comments