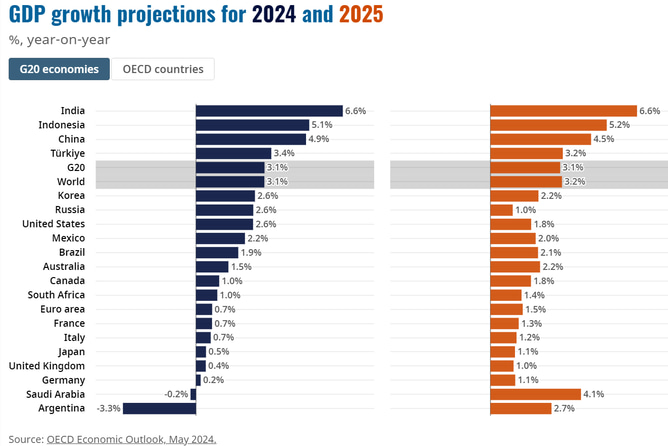

The OECD has forecasted that the global economy will experience steady growth in 2024, followed by an acceleration in 2025. This projection is primarily based on the easing of inflationary pressures in key economies like the United States, Eurozone, and major emerging markets. The improving economic outlook, bolstered by the recovery in consumer spending and industrial activity, is expected to pave the way for stronger global expansion.

Source:- bbc news

However, the report also highlights that risks remain. Geopolitical tensions, such as the ongoing conflicts and trade disputes, along with high global debt levels, continue to pose challenges to global stability. These uncertainties could dampen the pace of recovery, particularly for countries heavily reliant on external trade or those facing internal political instability.

Source:- news 18

The OECD also noted that structural reforms and focused policy interventions will play a crucial role in mitigating these risks and fostering a sustainable growth path. Moreover, the shift toward green technologies and digitalization is expected to be key drivers of productivity and investment, particularly in advanced economies. Despite the challenges, the overall global outlook remains positive, with growth anticipated to rise beyond 2024 as economies adjust to new post-pandemic realities.

These optimistic projections are contingent on various factors, including the potential for renewed global collaboration and the effective management of inflationary pressures. The OECD urges policymakers to prioritize resilience through structural reforms and international cooperation to ensure that the benefits of economic recovery are broadly shared. Additionally, attention to environmental sustainability and technological advancements is critical for long-term prosperity.

In conclusion, the OECD’s report signals cautious optimism for the world economy, with an expected acceleration in 2025 if risks are carefully managed and economic policies align with current challenges and opportunities.

Share your views in the comments