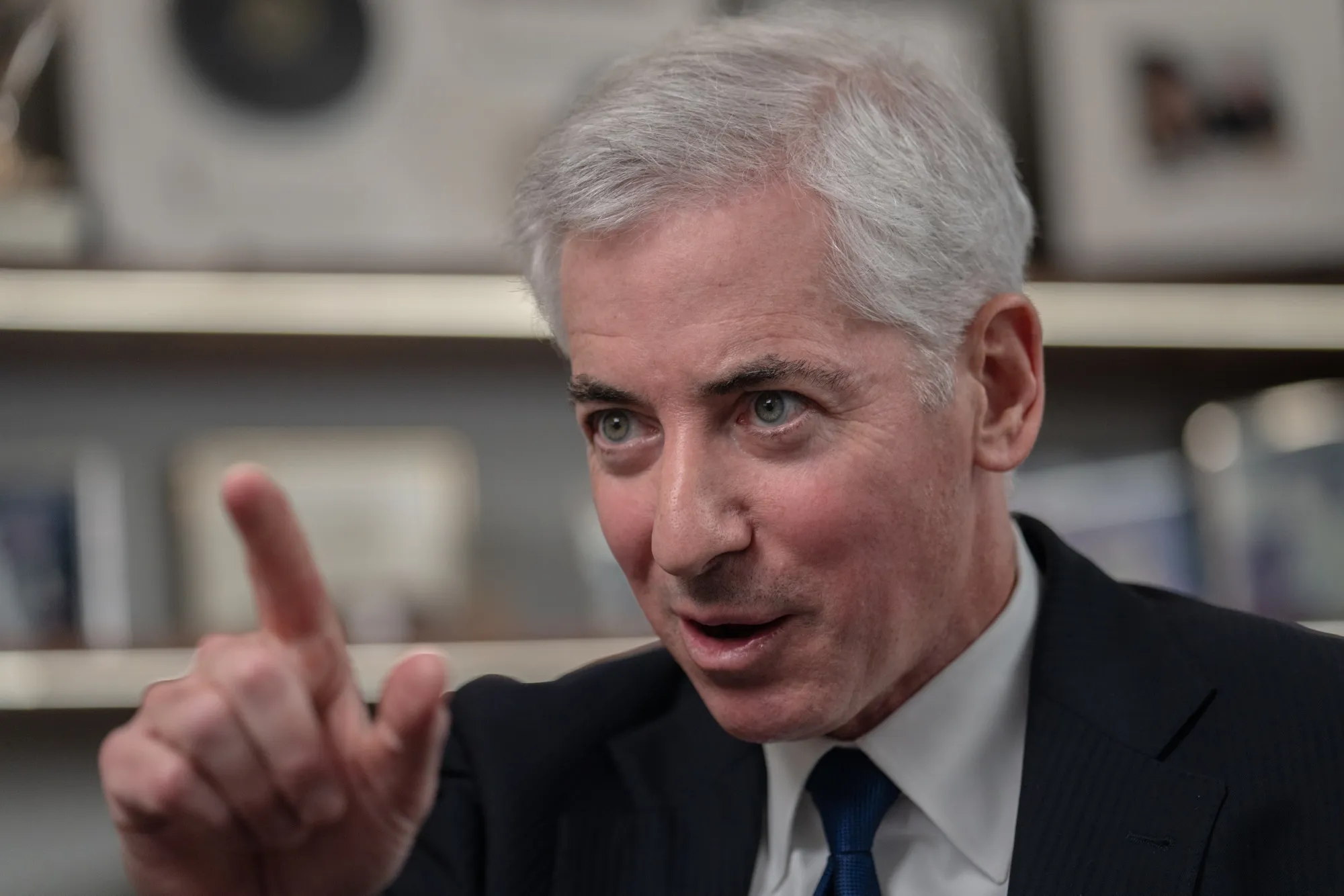

Billionaire hedge fund manager Bill Ackman is making big bets on a select few stocks, with nearly half of his $13.4 billion hedge fund, Pershing Square Capital Management, invested in just three companies. This concentrated strategy highlights his strong confidence in the future growth of these businesses.

Source:- bbc news

Ackman has allocated a substantial portion of his fund to three key stocks: Universal Music Group (UMG), Lowe’s, and Canadian Pacific Kansas City (CPKC). His investment approach focuses on companies with strong fundamentals, competitive advantages, and long-term growth potential.

Universal Music Group, a global leader in music entertainment, stands as one of Ackman’s largest holdings. With the increasing growth of streaming platforms and music consumption worldwide, UMG offers a compelling growth story, making it a top pick for Ackman’s portfolio.

Lowe’s, the U.S.-based home improvement retailer, is another significant bet. With the booming housing market and an increased focus on home renovations, Ackman believes Lowe’s is well-positioned to capitalize on these trends and deliver strong returns.

Lastly, Ackman has placed a considerable stake in Canadian Pacific Kansas City, a major railway company. The merger between Canadian Pacific and Kansas City Southern is expected to create a powerhouse in North America’s transportation sector, and Ackman is betting on its long-term success as supply chains continue to strengthen.

This concentrated approach underscores Ackman’s belief in the resilience and growth potential of these stocks. By focusing on a few high-conviction investments, he aims to maximize returns, despite the risks that come with such a strategy. With a keen eye for high-quality businesses, Ackman’s portfolio reflects his strategic outlook for the future.

Share your views in the comments