The President stated that the government has passed legislation like the Insolvency and Bankruptcy Code (IBC) and implemented other reforms over the previous ten years to safeguard India’s banking industry. The non-performing assets (NPA) of public sector banks, according to her, were steadily declining.

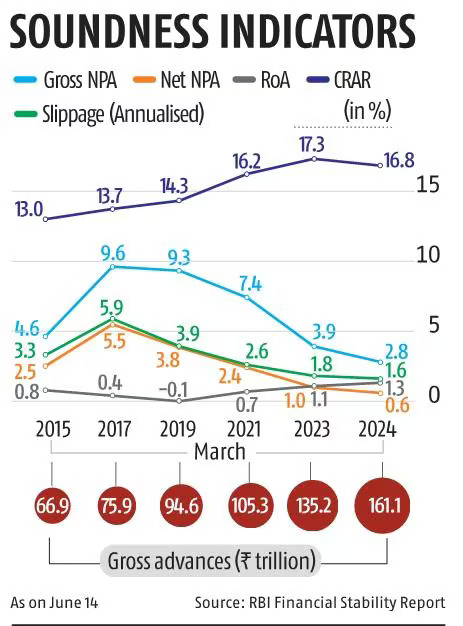

The FSR, which states that at the end of March of this year, the net non-performing asset ratio (NPA ratio) of scheduled commercial banks dropped to 0.6% and the gross NPA ratio down to 2.8%, supports this. As per the RBI, banks’ gross bad loan ratio has dropped to its lowest point in twelve years.This notable decline suggests that banks are handling their non-performing loans more effectively, which lowers the likelihood of defaults.

Source: Business StandardReserve Bank of India

It is impossible to overstate how detrimental non-performing assets are to the long-term stability and expansion of the Indian banking industry and how much they affect the state of the economy as a whole. Through the expediting of the insolvency case resolution procedure, the IBC has aided numerous banks and financial lenders in realising their obligations since it was implemented in 2016.

This is critical for the fastest-growing major economy in the world, which wants to be the first choice for international investors. Investor confidence may suffer from uncertainties and fears over India’s legal and regulatory environment.

Source: CNBC- TV 18

The President has asserted that India has one of the strongest banking sectors in the world, but the RBI has underlined that banks and other financial institutions are actively supporting economic activities through constant credit growth due to their better balance sheets.

Even while there is still need for improvement in terms of making banks more resilient and lucrative, these observations should reassure domestic investors. Every client worries about the security of their assets and deposits; the banks’ capacity to manage shocks to the system and reduce risks can have a significant impact on customers’ financial well-being.

What do you think about this? Comment below.