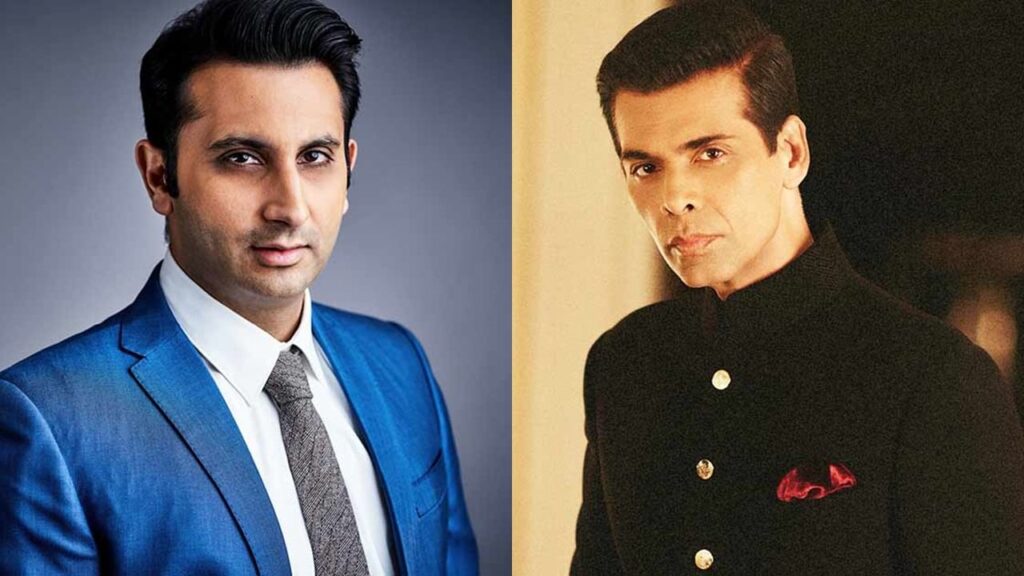

The recent announcement of Karan Johar’s Dharma Productions selling a stake to Adar Poonawalla for ₹2,000 crore has sparked significant debate over the valuation and implications of this deal. This deal comes at a time when Dharma Productions, while historically influential in Bollywood, is facing financial challenges. Despite a reported revenue increase from ₹276 crore to ₹1,040 crore in FY23, the company also experienced a drastic drop in net profit, down 59% to just ₹11 crore, attributed to rising expenses

Source:- bbc news

Critics argue that the ₹2,000 crore valuation may seem inflated given these financial struggles. The ongoing transition towards digital platforms and changing consumer preferences pose additional risks for traditional film production houses. While the potential for future profitability exists, particularly with projects in digital content under their new ventures, questions linger about whether this valuation accurately reflects the company’s current and future worth

Source:- bbc news

Moreover, the deal indicates Karan Johar’s efforts to monetize his stake, a move he has been contemplating for some time amid previous attempts failing due to valuation disagreements

As Reliance Industries also eyes a stake in Dharma, the competitive dynamics within India’s media landscape suggest that investors like Poonawalla see potential in consolidating content production assets despite the current challenges.

In summary, while the deal’s price tag is substantial, its justification rests on future growth projections amidst a rapidly evolving industry landscape. For more insights, you can check the original articles

Share your views in the comments