India’s fiscal deficit for the first half of the financial year 2024-25 (FY25) has reached 29.4% of the government’s target, according to recent reports. This figure is notable as it reflects the government’s spending and revenue collection trends during the April-September period.

Source:- bbc news

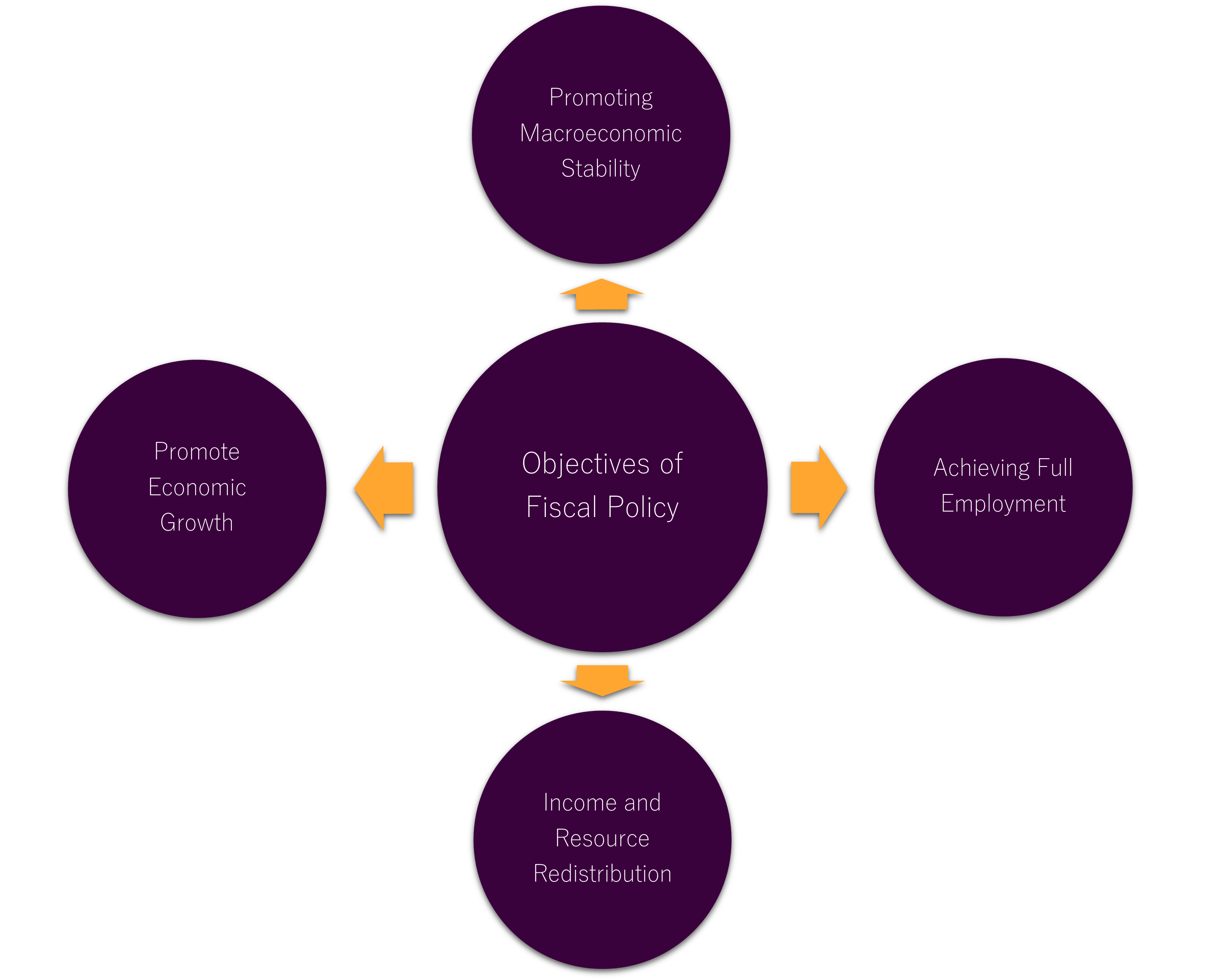

The fiscal deficit, which indicates the difference between the government’s total expenditure and its total revenue (excluding borrowings), is a critical measure of financial health and sustainability. The target for FY25 was set at 5.9% of the GDP, and achieving this requires careful management of public finances.

Source:- news 18

During the April-September period, the government faced significant challenges in balancing its fiscal responsibilities against the need for increased spending in sectors like infrastructure, health, and social welfare. The expenditure was driven by various initiatives aimed at stimulating economic growth and supporting recovery from the impacts of the pandemic.

Revenue generation has also been a focus, with the government relying on tax collections and disinvestment to meet its targets. However, economic uncertainties and global headwinds have posed challenges to revenue growth, potentially impacting the fiscal deficit’s trajectory.

As the government moves into the second half of the fiscal year, the emphasis will be on improving revenue collections while managing expenditures. Policymakers are expected to keep a close eye on inflation, interest rates, and global economic conditions, which could influence fiscal policies and strategies.

In conclusion, while the fiscal deficit’s current level at 29.4% of the FY25 target reflects ongoing economic challenges, it also underscores the government’s commitment to driving growth and maintaining fiscal discipline. Stakeholders will be monitoring these developments closely as the year progresses.

Share your views in the comments