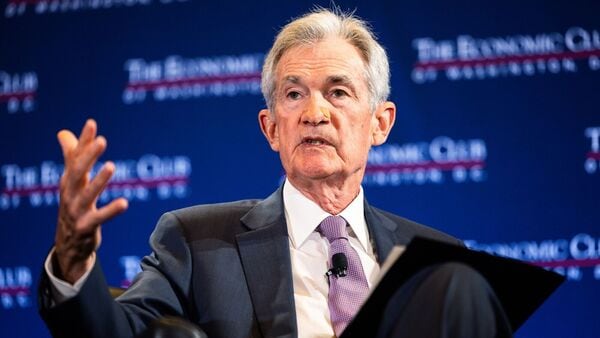

Federal Reserve Chair Jerome Powell is expected to address the ongoing tension between labor market strength and inflation control at the Jackson Hole Economic Symposium. The event, held annually in Wyoming, serves as a key platform for central bankers to outline monetary policy directions.

Source:- news 18

Labor Market vs. Inflation: The Dilemma

The U.S. labor market remains robust, with low unemployment rates and steady job creation. However, this strength poses a challenge for the Fed. A tight labor market can drive wages higher, contributing to inflationary pressures. Powell has previously emphasized the need to balance these dynamics, ensuring that inflation is brought under control without severely hampering job growth.

Source:- BBC new

Current Economic Context

Inflation in the U.S. has been persistently above the Fed’s 2% target, despite aggressive interest rate hikes over the past year. While some price pressures have eased, core inflation—excluding volatile food and energy prices—remains elevated. This situation puts the Fed in a tough spot: too much tightening could stifle economic growth and lead to higher unemployment, but too little could allow inflation to become entrenched.

Powell’s Likely Approach

Powell is expected to reiterate the Fed’s commitment to bringing inflation down, possibly signaling further rate hikes or prolonged higher rates. However, he may also acknowledge the risks to employment, hinting at a more data-dependent approach moving forward. Markets will be closely watching for any shifts in tone that suggest how the Fed might navigate the delicate balance between cooling inflation and maintaining labor market health.

Global Implications

The outcome of Powell’s speech could have global ramifications, influencing currency markets, bond yields, and central bank policies worldwide. A hawkish stance might strengthen the dollar and lead to tighter financial conditions globally, while a dovish tone could provide relief to emerging markets facing debt pressures.

Share your views in the comments