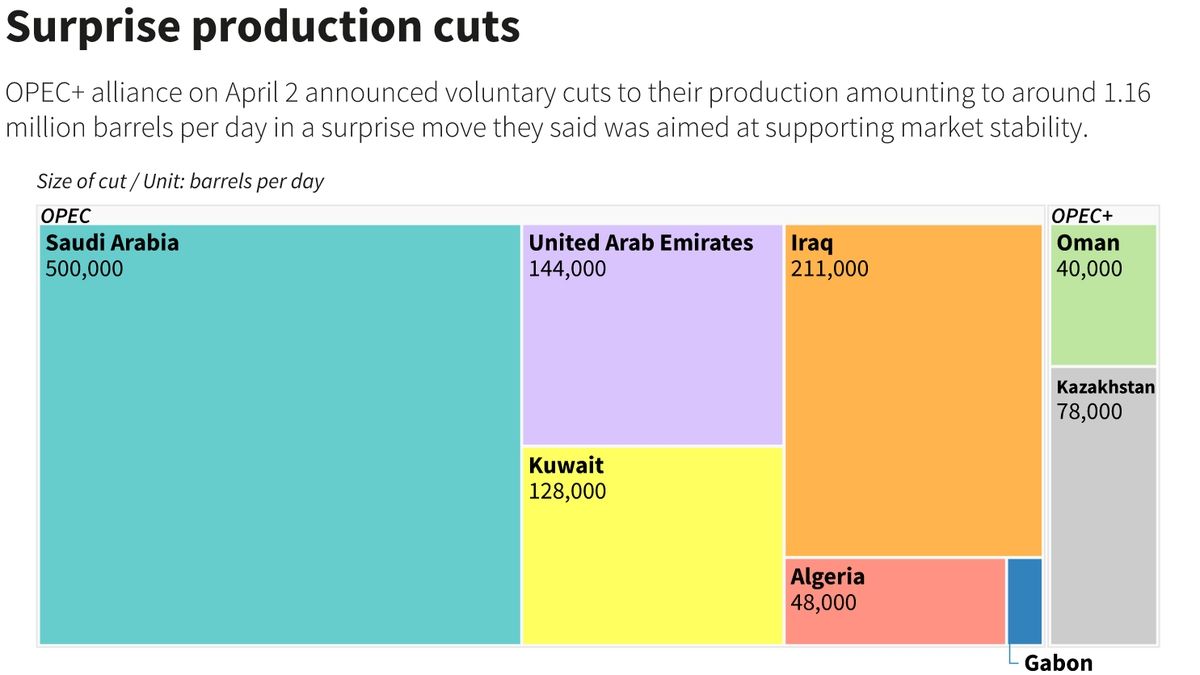

In a bid to stabilize oil markets and support prices, OPEC+ members, led by Saudi Arabia and Russia, have decided to deepen their production cuts. This decision underscores the ongoing efforts of the alliance to rebalance the global oil market amidst ongoing uncertainties and challenges.

Saudi Arabia, the de facto leader of OPEC, and Russia, a key non-OPEC member, have been pivotal in orchestrating production adjustments within the OPEC+ framework. Their coordinated actions have often been crucial in influencing oil prices and market sentiment.

SOURCE:- Medriva

The recent extension of production cuts signals a continued commitment by both countries to collaborate in managing oil supply dynamics. By opting to deepen cuts, they aim to counteract the lingering oversupply and bolster prices, which have been affected by various factors including the ongoing global economic recovery, geopolitical tensions, and fluctuations in demand.

SOURCE:- BBC NEWS

Saudi Arabia, in particular, has consistently advocated for measures to support oil prices, given its significant reliance on oil revenues to sustain its economy. The kingdom’s proactive stance within OPEC+ reflects its determination to ensure market stability and preserve its position as a leading oil exporter.

Likewise, Russia has a vested interest in maintaining stable oil prices, albeit for slightly different reasons. While oil revenues are important to the Russian economy, the country’s diversified economic base provides it with a certain degree of resilience against oil price fluctuations. Nonetheless, Russia’s cooperation within OPEC+ underscores its recognition of the benefits of price stability for its energy sector and broader economy.

The decision to deepen production cuts comes against the backdrop of ongoing geopolitical tensions, including uncertainties surrounding Iran’s nuclear deal negotiations and the potential for supply disruptions in key oil-producing regions. These geopolitical factors add layers of complexity to the already intricate dynamics of the global oil market, making coordination among oil-producing nations all the more crucial.

Furthermore, the evolving energy transition and increasing focus on renewable energy sources pose long-term challenges to the oil industry. While the demand for oil is expected to remain robust in the near term, particularly as global economies recover from the COVID-19 pandemic, the transition to cleaner energy sources presents a strategic imperative for oil-producing countries to adapt and diversify their economies.

The decision by Saudi Arabia and Russia to deepen OPEC+ production cuts underscores their commitment to stabilizing oil markets amidst ongoing uncertainties. By aligning their strategies and coordinating production adjustments, these key players aim to mitigate oversupply concerns and support prices, while navigating the complex geopolitical and economic landscape shaping the future of the oil industry.

Share your views in the comments