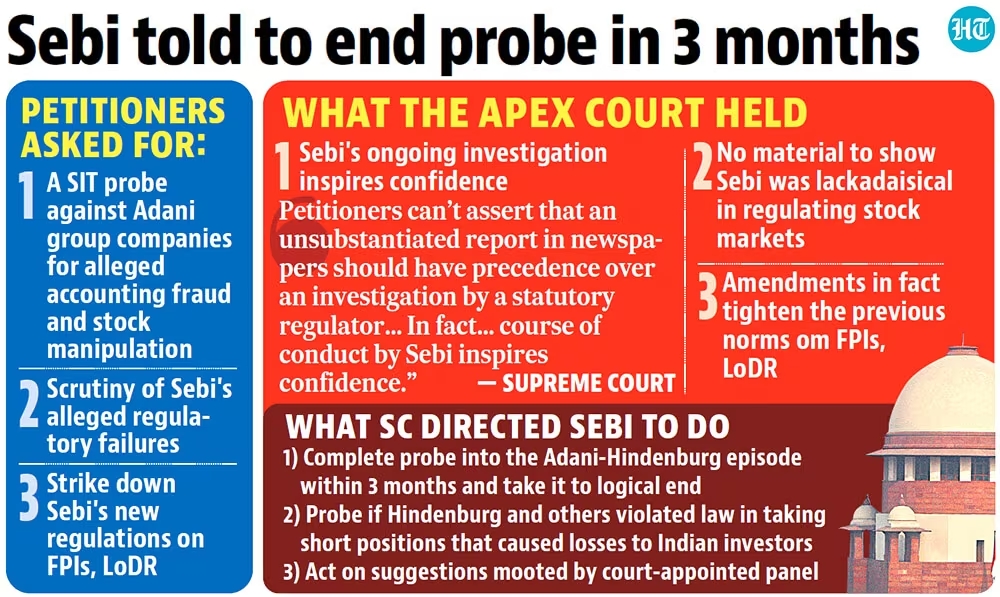

The US short seller Hindenburg Research filed the claims a year ago. With the statement that there was “no apparent regulatory failure” and that SEBI was “conducting a comprehensive investigation,” the court showed confidence in the stock market regulator.

It stated that SEBI had finished looking into 22 concerns and gave it three months to finish looking into two instances that were still open. The government was also requested to look into if any legal violations by short sellers of shares resulted in losses for investors.

There are still unanswered questions regarding the majority of the significant allegations brought against the Adani Group including matters of market manipulation, foreign entity and FPI ownership, money flows, and related party transactions that have not yet been thoroughly looked into by SEBI.

Source: Hindustan Times

According to SEBI, “as many of the entities linked to these foreign investors are located in tax haven jurisdictions, establishing the economic interest of shareholders of the 12 FPIs remains a challenge” . Even before the Hindenburg report brought up certain concerns, SEBI has received complaints concerning the Adani Group from various government entities.

The court ruled that because SEBI’s disclosure requirements and regulations governing FPIs were already strict, it could not order SEBI to alter them. It further stated that the information cited by the petitioners in their request for additional research could only be considered inputs. It stated that because the findings from the Organised Crime and Corruption Reporting Project did not constitute definitive proof, it could not accept their veracity in exposing the flaws in the SEBI investigations.

That begs the question of whether, precisely for that reason, more research would have been warranted. An SIT would have the police authority to locate and provide solid evidence, but investigative journalists do not. The verdict makes it quite evident that the court wished to stay out of SEBI’s purview.

Source: India Today

This is most likely a result of SEBI’s independent authority within its regulatory role. The court held that the judiciary could only examine the regulatory framework to see whether there was arbitrariness or a breach of basic rights, and that it could only request a SEBI inquiry in extremely unusual and extraordinary situations.

It believed that there was no such situation in this instance. SEBI must finish its investigations by the deadline set by the court and, more significantly, make all of its findings available to the general public. The issue is significant because it affects the stock market, is of public interest, and has political ramifications. The public has a right to know how SEBI arrived at its findings. Only then could all of the short seller’s queries be addressed.

What do you think about this? Comment below.