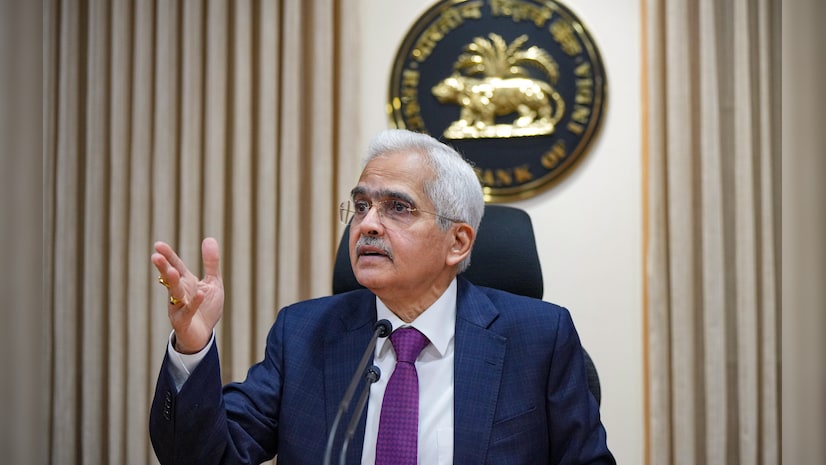

According to a report by the State Bank of India (SBI), the Reserve Bank of India (RBI) is expected to diverge from other major central banks and maintain its current monetary policy stance until the end of the fiscal year 2025. This prediction comes amid global monetary tightening, with central banks in advanced economies, like the U.S. Federal Reserve and the European Central Bank, continuing to raise interest rates to combat persistent inflation.

Source:- news 18

The SBI report highlights that the RBI’s decision to maintain a status quo is driven by several domestic factors. India’s inflation, while elevated, is largely driven by supply-side issues rather than demand, making the case for policy tightening less compelling. Additionally, the RBI has kept inflation within its target range of 2-6% despite external pressures. The report also notes that India’s economic growth, though resilient, still faces uncertainties, particularly due to external shocks like geopolitical tensions, global trade disruptions, and fluctuating commodity prices.

Source:- BBC news

Moreover, SBI analysts suggest that the RBI’s decision to maintain its current stance is also influenced by its efforts to support economic recovery post-pandemic. The central bank is expected to continue with its accommodative stance, especially in light of the need to support credit growth and investment, which are crucial for sustaining the economic momentum.

While other central banks are tightening policy to rein in inflation, the RBI’s approach appears more cautious and calibrated. The report concludes that this divergence from global trends reflects the RBI’s assessment of the unique dynamics of the Indian economy, focusing on balancing growth and inflation management. Thus, unless there is a significant change in the domestic or global economic environment, the RBI is likely to maintain its current policy stance until the end of FY25.

Share your views in the comments