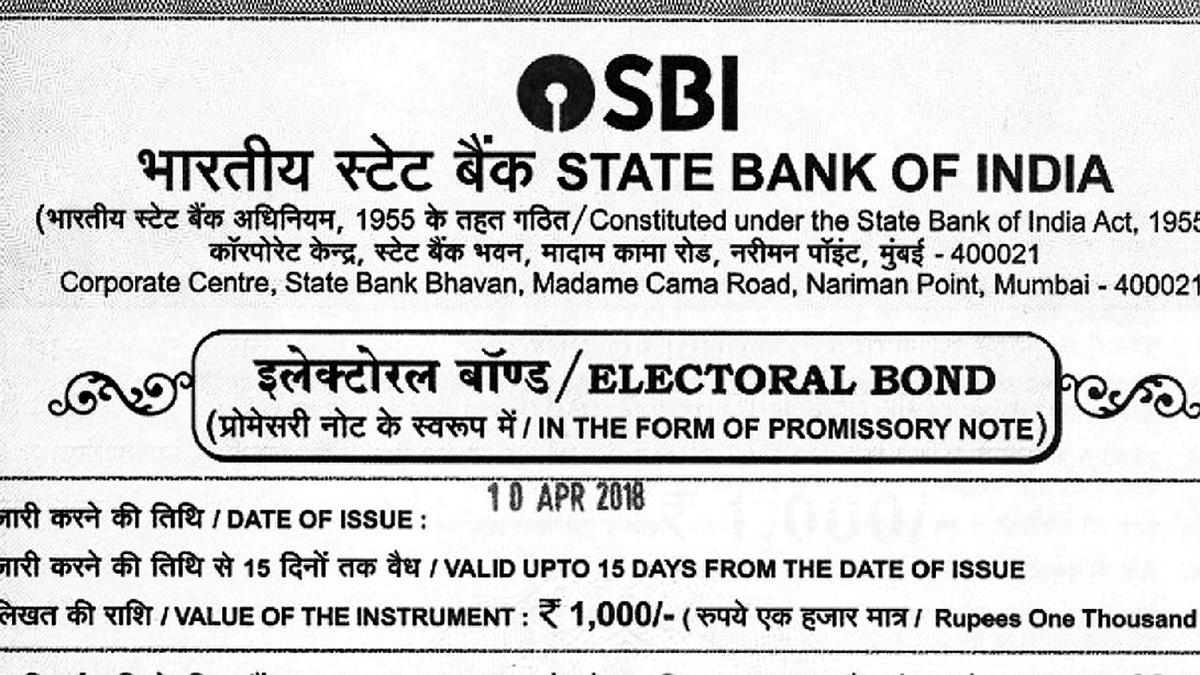

Many believe that the bank’s justifications for why it couldn’t follow the court’s order were unsupportable. The court ruled last month that the electoral bonds program was unlawful and instructed the SBI to provide the ECI with information about the bonds by March 6th, including dates, denominations, and the names of the parties that received them.

By March 13, the ECI was required to make them public. However, the SBI has informed the court that it will only be able to reconcile the data by the end of June. The explanation, which was given near the court’s scheduled date, is unpersuasive.

Source: The Hindu

According to the bank, the data is divided into two silos: one for the bond’s purchase and another for the parties that actually got the bonds. It asserts that matching donations with political parties is challenging. There are doubts about this assertion. Based on RTI papers, it has been noted that when the union finance ministry requested bond data, the SBI was able to compile it nationwide in less than 48 hours.

Former finance secretary Subhash Chandra Garg, who handled the bond introduction, stated that the SBI would require “not more than a day” to provide the information requested by the court. According to the bonds scheme’s 2018 criteria, the bank must provide the information to any court that requests it.

Source: NDTV

The Supreme Court ordered the bank to keep these records in 2019. Subsequently, the bank presented the information to the court in a sealed cover without requesting a delay. The court’s order must be interpreted within its surroundings. With the elections in a few weeks, the information is pertinent and significant. Voters have a right to know how political contributions affected the parties’ and governments’ policies and choices.

Many former civil personnel have asked the Election Commission to hold off on announcing the election dates until after the SBI provides information regarding the bonds. If the SBI doesn’t budge, the court may examine it closely to see if it qualifies as contempt. It has the authority to direct the bank to turn over the information so that an expert committee it has constituted can review it. Given the significance and great public interest in the issue, immediate action is required.

What do you think about this? Comment below.