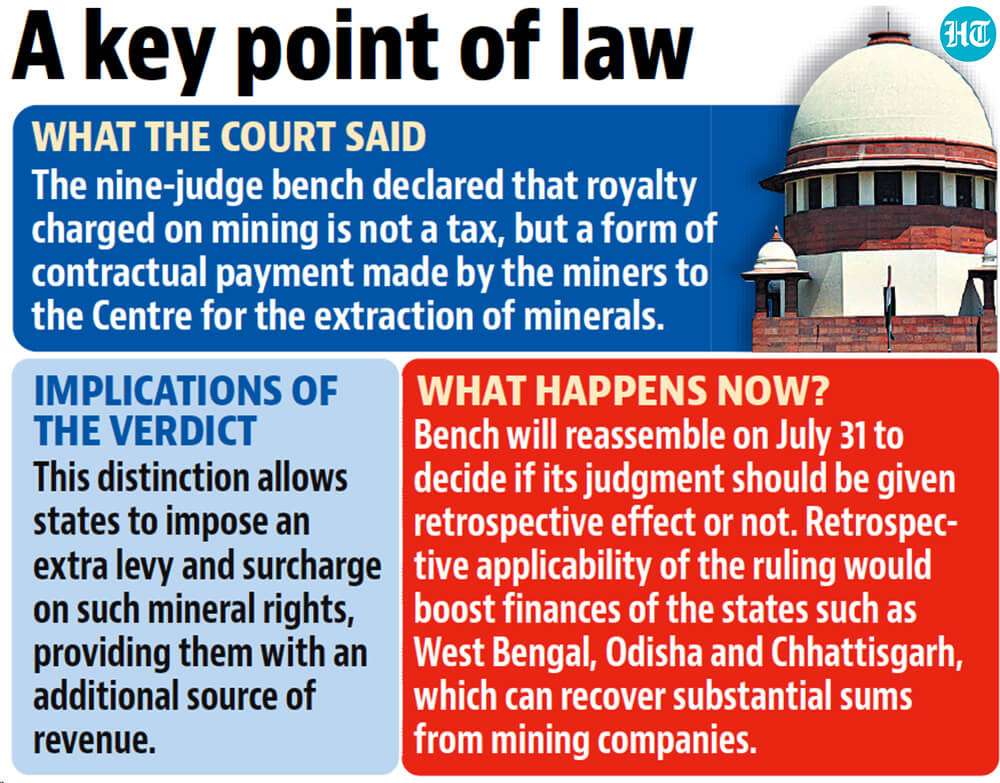

According to the Supreme Court, states have the legislative authority to levy taxes on mines, minerals, and land holding minerals. Royalties paid on minerals are not considered taxes. The Mines and Minerals (Development and Regulation) Act, 1957, was the central point of contention.

The Center had maintained that only Parliament had the authority to tax minerals, citing the Act. But a bench of the SC decided that the statute did not prevent states from taxing mines and mineral development.

Source: X.com

Mineral-rich states like Jharkhand and Odisha, who are attempting to recoup millions of crores of rupees in mine and mineral-related taxes charged by the Central government, should profit from the ruling.

Negotiations may have been used to settle the issue if the Union Government had been accommodating of the states’ demands and goals. Rather, to end the impasse, the supreme court had to step in. Discord amongst Center-states is nothing new, but in recent years it has been more frequent and heated.

Source: NEWS 9Live

The Opposition has protested the 2024–25 Union Budget’s special packages for Bihar and Andhra Pradesh, claiming that these packages represent discrimination against states where the BJP is not in power. The Chief Ministers of various states ruled by the opposition have decided to boycott the July 27 NITI Aayog meeting in protest of the budget, which they view as “politically biassed,” which encapsulates the awful state of affairs.

Cooperative federalism is the foundation for amicable Union-state relations, as the Sarkaria Commission had emphasised back in the late 1980s. The Commission had issued a warning, noting that increasing power centralization made people’s concerns worse rather than better. The panel report should be dusted off and carefully examined by the Center. This developing country cannot be transformed into Viksit Bharat by an oppressive or unjust Union Government.

What do you think about this? Comment below.