The US Federal Reserve is expected to adopt a “cut-and-pause” strategy in the coming months to balance its dual mandate of controlling inflation and ensuring maximum employment, according to market experts. This cautious approach signals fewer interest rate cuts in 2025 compared to earlier market expectations.

Source:- bbc news

Economists predict the Fed will begin rate reductions in mid-2024, driven by cooling inflation and signs of economic slowdown. However, the pace of easing is likely to be gradual, as the central bank remains vigilant about maintaining price stability. With inflation still above the Fed’s 2% target and a resilient labor market, policymakers are treading carefully to avoid reigniting price pressures.

Source:- news 18

The “cut-and-pause” approach allows the Fed to assess the economic impact of each rate reduction before proceeding further. This method reflects lessons from past cycles where aggressive rate cuts risked creating economic imbalances. Experts suggest that the Fed could trim rates by 100–150 basis points by the end of 2025, less than previously anticipated.

Market sentiment indicates a recalibration of expectations, with investors factoring in a longer period of higher rates before a full easing cycle. This outlook has significant implications for equity and bond markets, as well as sectors like real estate and banking, which are sensitive to interest rate changes.

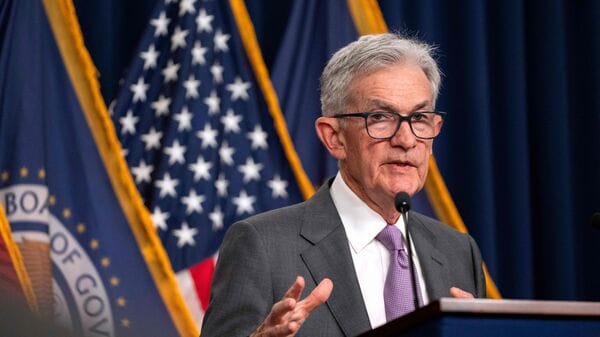

Fed Chair Jerome Powell has reiterated the importance of a data-driven approach, emphasizing that future policy adjustments will depend on incoming economic data. The central bank aims to strike a delicate balance between fostering growth and curbing inflationary pressures, ensuring sustainable economic expansion.

As the Fed navigates these challenges, its policies will remain a focal point for global financial markets, influencing economic trends well beyond the US borders.

Share your views in the comments